In a surprising twist that has sent ripples through global financial markets, Ghana’s national currency, the Cedi, has emerged as the top-performing currency in the world, overtaking the US Dollar in a manner few financial analysts predicted. For many Ghanaians and Pan-African economic watchers, this achievement represents more than a currency milestone—it’s a symbol of resilience, reform, and the possibility of African nations shaping their own financial destinies.

Yet, just as Ghana celebrates, the International Monetary Fund (IMF) has stepped forward with a pointed warning. The IMF’s concerns raise critical questions: Is Ghana’s rapid rise a sustainable success, or is it a momentary economic spike that could trigger hidden risks? And more importantly—why does the IMF feel the need to intervene at this stage?

The Rise of the Cedi – A Case Study in Economic Recovery

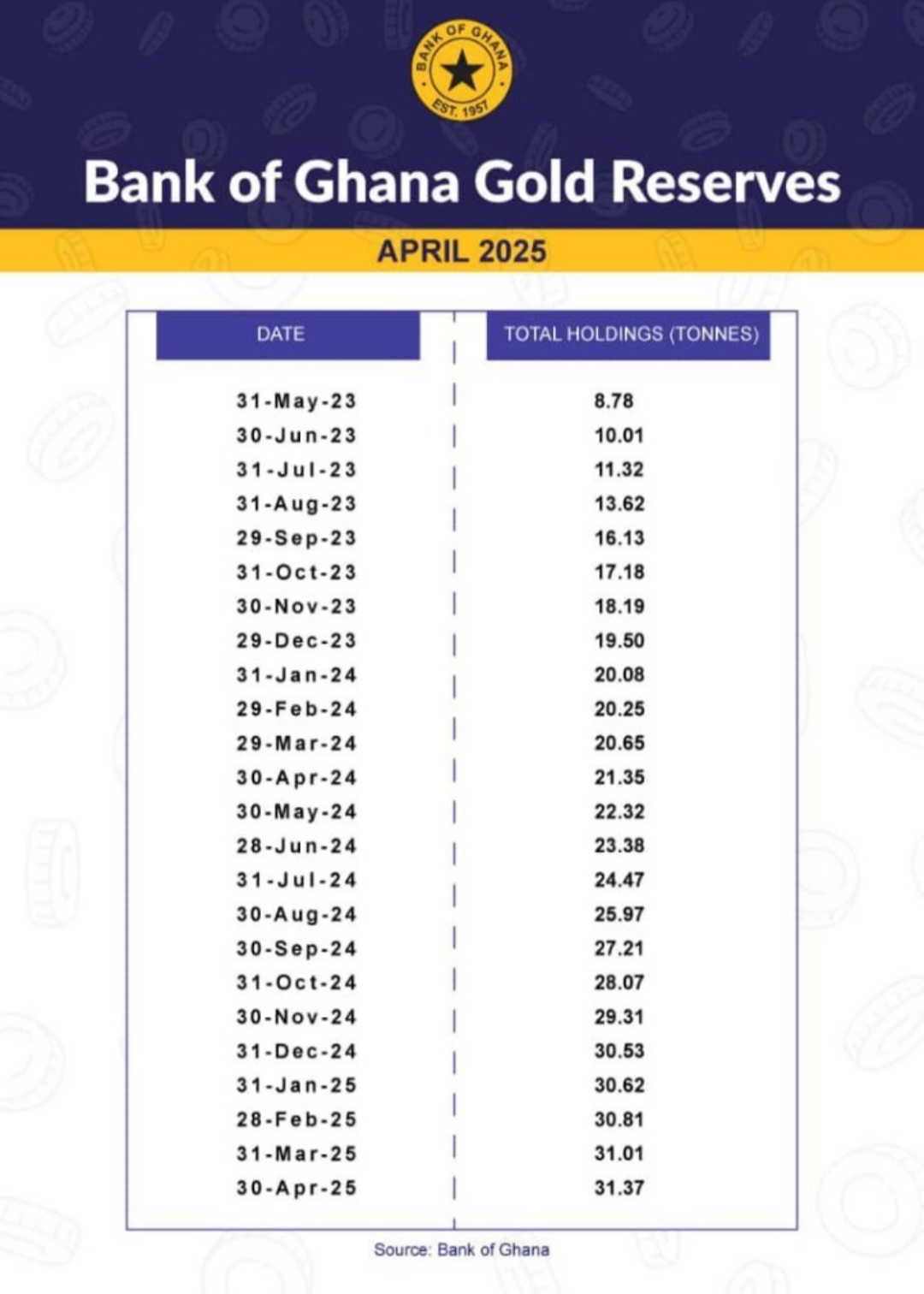

In recent months, the Cedi’s performance has been nothing short of remarkable. Ghana’s government has implemented a series of fiscal and monetary policies designed to stabilize the economy, curb inflation, and attract investment. Higher export earnings from gold, cocoa, and oil, combined with improved investor confidence, have helped boost the currency’s value.

For ordinary citizens, the stronger Cedi has translated into lower import costs, increased purchasing power, and renewed optimism. In a global economy where the US Dollar often dominates, Ghana’s currency surge has been a source of national pride and a beacon for other African economies aiming to achieve economic sovereignty.

The IMF Steps In – Concern or Control?

Despite the celebratory tone within Ghana, the IMF’s warning has sparked debate. The Fund has questioned whether the Cedi’s sharp appreciation could destabilize trade balances, harm export competitiveness, or mask underlying vulnerabilities in the economy.

Critics, however, see a more political dimension. Across Africa, there’s growing skepticism about the IMF’s role and whether its interventions are genuinely about stability—or about preserving the influence of global financial institutions over African economies.

This tension is not new. Historically, the IMF has been accused of imposing structural adjustment programs that often left African nations in cycles of debt dependency. Ghana’s success story, if sustained, could challenge this paradigm, offering a model of self-driven economic recovery without over-reliance on Western-led financial frameworks.

Implications for Africa – A Continental Wake-Up Call

Ghana’s achievement has stirred conversations far beyond its borders. In Nigeria, Kenya, South Africa, and other African economies, policymakers are taking note: If Ghana can strengthen its currency and challenge the global status quo, perhaps others can too.

A stronger, more independent African financial system could reduce reliance on external aid, strengthen intra-African trade under the African Continental Free Trade Area (AfCFTA), and give the continent greater bargaining power in international markets.

But the IMF’s quick intervention serves as a reminder of the geopolitical stakes. A more economically independent Africa could shift the balance of global power—something not all major economies would welcome.

The Road Ahead – Can Ghana Protect Its Gains?

For Ghana, the challenge now is safeguarding its progress. Sustaining a strong currency requires more than temporary market momentum—it demands structural economic resilience, diversified exports, prudent fiscal policy, and an unwavering commitment to reducing dependency on foreign debt.

If managed well, Ghana could inspire a wave of financial revolutions across the continent, giving rise to an era where African nations set the terms of their economic engagement with the rest of the world. But if mismanaged, the gains could be reversed, reinforcing the IMF’s cautionary narrative.

A Pan-African Perspective

This is more than a Ghanaian story—it’s a Pan-African moment. It’s about the possibility of rewriting Africa’s economic narrative, breaking from a century of dependency, and embracing a future defined by self-determination and economic sovereignty.

Whether you view the IMF’s warning as genuine economic advice or a protective move by entrenched financial powers, one fact is undeniable: Ghana has proven that Africa is capable of rewriting the rules of the global economy.

The next chapter depends on whether the continent can stand united, learn from Ghana’s experience, and turn individual victories into a collective rise.

🇬🇭 IMF Sends Warning to Ghana After Cedi Outperforms US Dollar – What’s Really at Stake for Africa’s Economic Future

Leave a Reply