The move could help big bank owners of payment product head off cryptocurrency competition

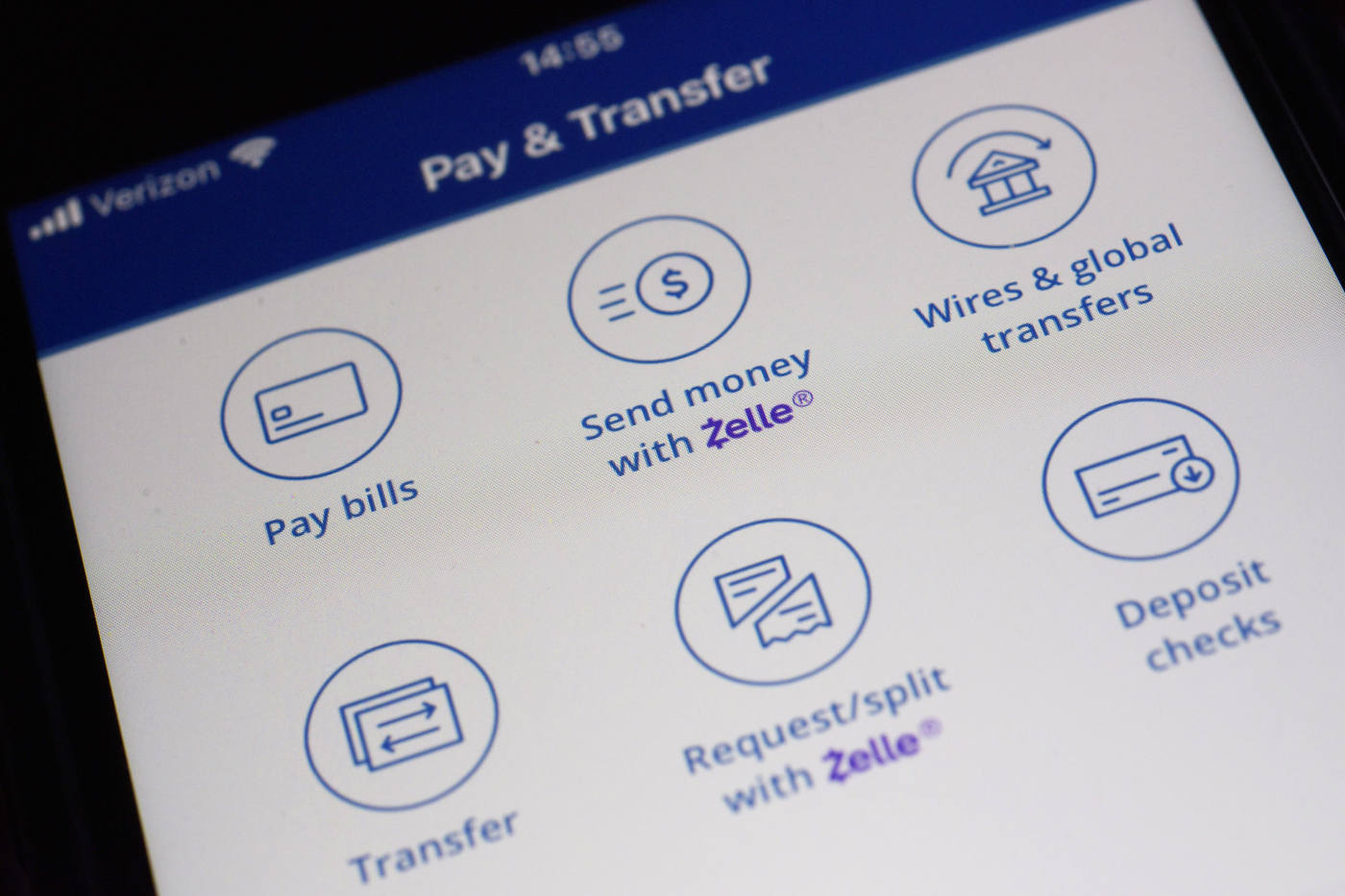

Zelle, the payments product owned by the country’s largest banks, said Friday that it plans to allow users to start making international payments using stablecoins, a type of cryptocurrency.

The move by Early Warning Services, which is owned by a consortium of banks that includes JPMorgan Chase and Wells Fargo, follows on the heels of legislation championed by the Trump administration designed to usher stablecoins into the regulated financial system.

The details

Zelle on Friday said the initiative would help users move money across borders, and that the service would be available to customers of any bank that is part of the Zelle network. It didn’t specify exactly how it would work or when it would launch.

The service would represent a significant expansion for Zelle, which has so far limited its payment services to users in the U.S.

Unlike its domestic payments product, the new initiative would entail the use of stablecoins, a digital currency that is pegged to a fiat currency such as the U.S. dollar. President Trump in July signed a bill that creates federal guardrails and oversight of stablecoins.

Since they are tied to real currency, stablecoins are supposed to maintain a more consistent value than other cryptocurrencies. That makes them particularly attractive as a payments tool, and the new legislation has led to all manner of companies, including Walmart and Amazon.com, exploring how to issue or use their own coins.

The context

The Wall Street Journal in May reported that the nation’s biggest banks were looking into ways to issue a stablecoin, including with Zelle, in a move intended to head off growing competition from the cryptocurrency industry.

Cryptocurrency advocates hope new legislation will foster more widespread adoption of stablecoins, both as a way to make payments and potentially as a way to store value.

Currently, stablecoins are primarily used as an on ramp and off ramp for purchasing other types of cryptocurrency. Stablecoins pegged to the U.S. dollar are also popular in countries where the local currency is subject to inflation.

Cross-border payments is one area in which those in the cryptocurrency and traditional finance industries agree that stablecoins could be particularly useful. Making an international payment without them typically involves transferring money across a series of institutions, making it costly and slow.

Write to Dylan Tokar at dylan.tokar@wsj.com

Leave a Reply