Updated U.S. inflation data for July, August, and September (PCE) is expected to be released today, which could change the situation for BTC.

➠ Current picture:

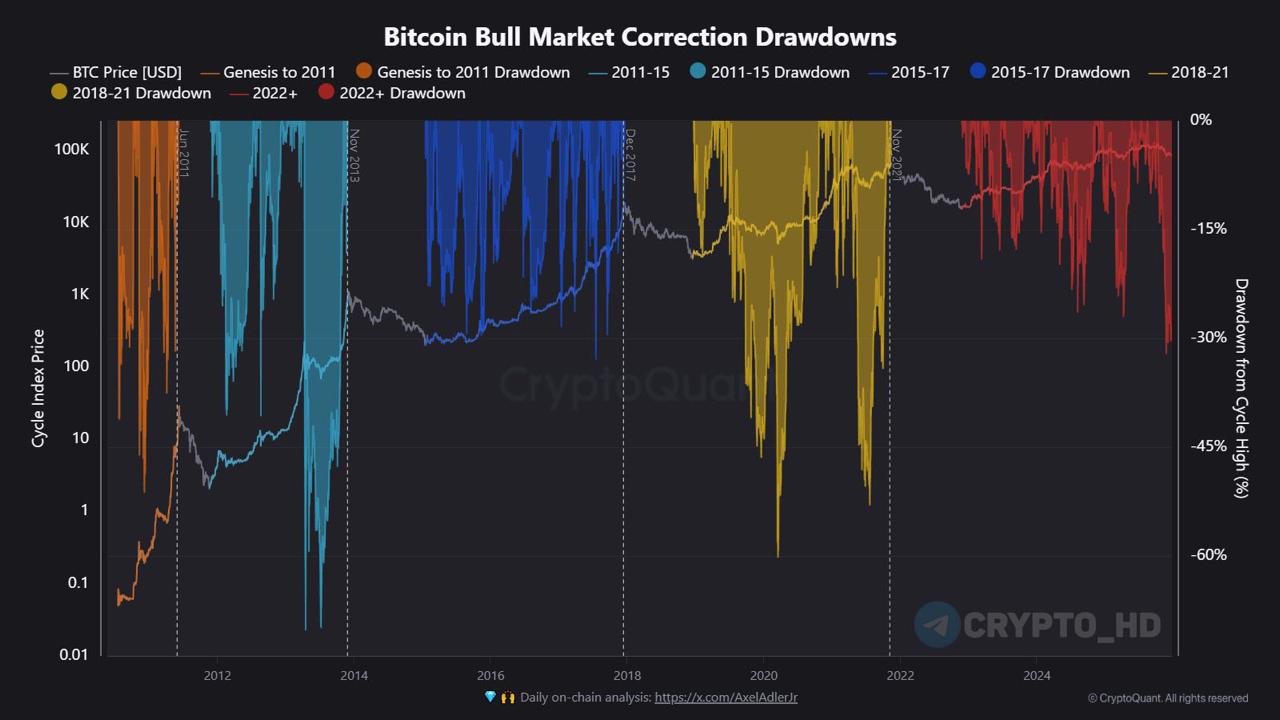

▪️ BTC: -30% from ATH.

▪️ Gold and Silver: new all-time highs.

▪️ S&P 500 and Nasdaq: just a step away from ATH.

➠ Defensive assets are overheated

▪️ Gold is trading +25% above its 200-day MA, Silver +45%. Such levels were last seen in 2020 (COVID era).

➠ Stocks remain strong

▪️ S&P 500: -1% from ATH. Nasdaq: -3% from ATH.

▪️ Risk assets are not collapsing — they are near record highs.

➠ Bitcoin is lagging behind other assets

▪️ Since August, the BTC/Nasdaq correlation has diverged.

▪️ Since July, the BTC/Gold correlation has turned negative.

▪️ Bitcoin is no longer moving in sync with either tech stocks or “hard money.”

➠ The reason for BTC’s underperformance is selling pressure

▪️ ETF outflows since ATH: -$5.1 billion.

▪️ Sustained whale selling since October.

▪️ Capital has flowed into Gold/Silver, while stocks are rising on AI hype.

▪️ There are not enough buyers at current levels to drive Bitcoin higher.

➠ Why today’s PCE data is critical

▪️ Softer data → dovish Fed expectations → a potential catalyst for a BTC reversal.

Bitcoin is falling while Gold is hitting record highs…

Leave a Reply